Please note that the entry is being recorded in the journal of the payee meaning who is entering the notes on the balance sheet meaning the customer.

Balance sheet wall street oais is important.

The balance sheet is one of three important financial statements intended to give investors a window into company s financial condition at a specific point in time.

It is important to understand the journal entries for notes payable.

Doing so will enable an individual to comprehend the nitty gritty.

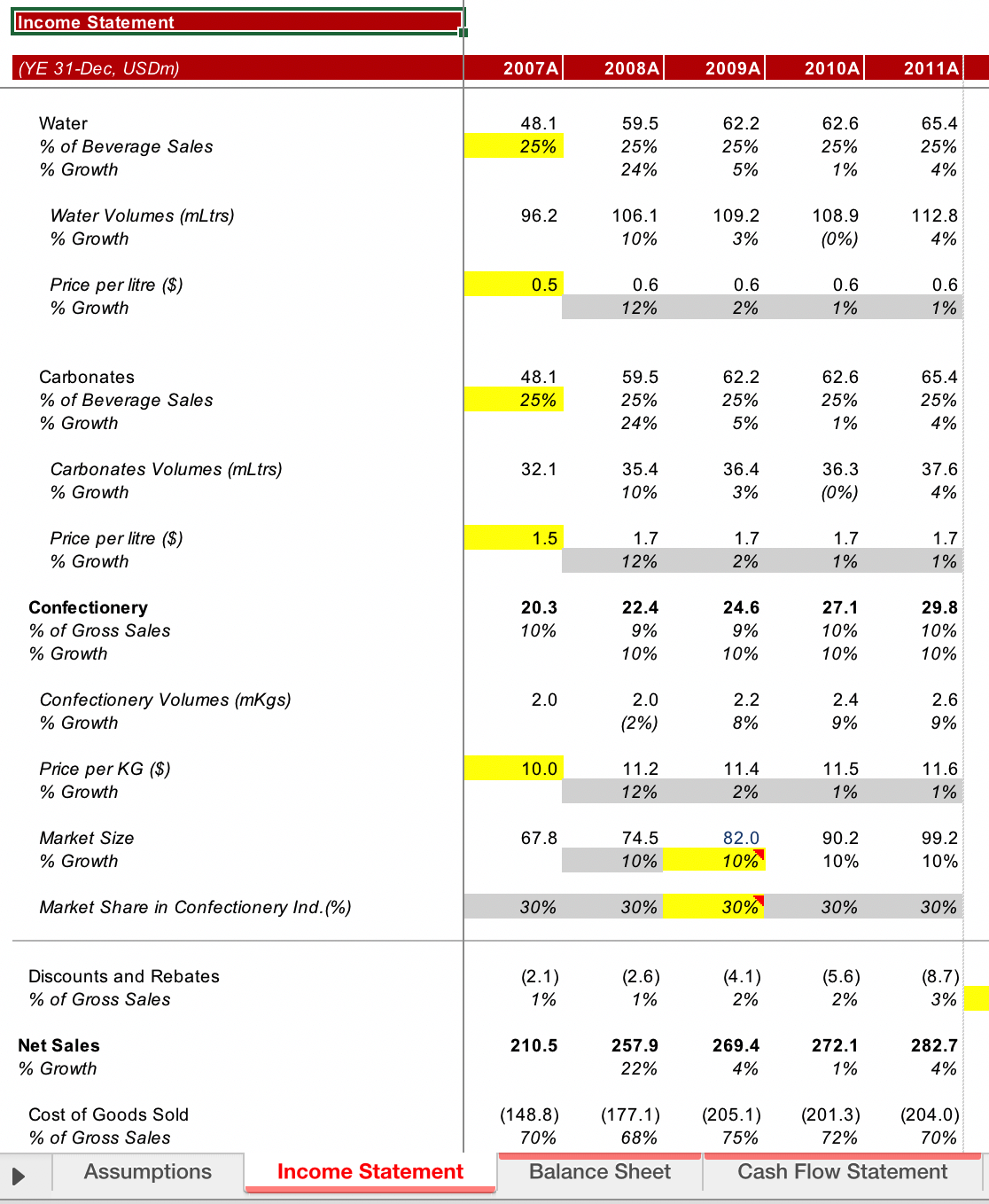

This template allows you to build your own company s financial statement showing the total assets liabilities and shareholders equity.

Assets what the company owns or is owed liabilities any money the company.

Additional analysis that comes from the balance sheet.

Because every balance sheet follows a specific formula and by definition must balance investors need some ways to analyze what a balance sheet is really saying.

A strong balance sheet usually means high qualify assets including a strong cash position very little or no debt and a high amount of shareholder s equity.

Two ratios that can be determined from the balance sheet are a company s debt to equity ratio and their acid test ratio.

The template is plug and play and you can enter your own numbers or formulas to auto populate output numbers.

Why is the balance sheet important.

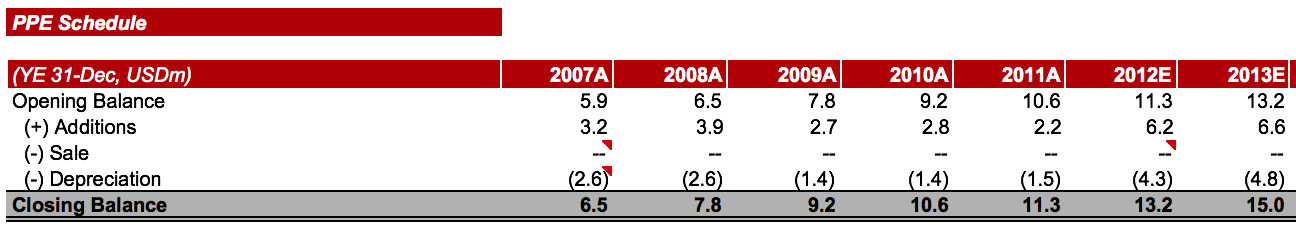

Accordingly we decided to list some basic best practices for projecting balance sheet line items below.

A business s balance sheet is a detailed list of its assets liabilities or money owed by the business and the value of the shareholders equity or net worth of the.

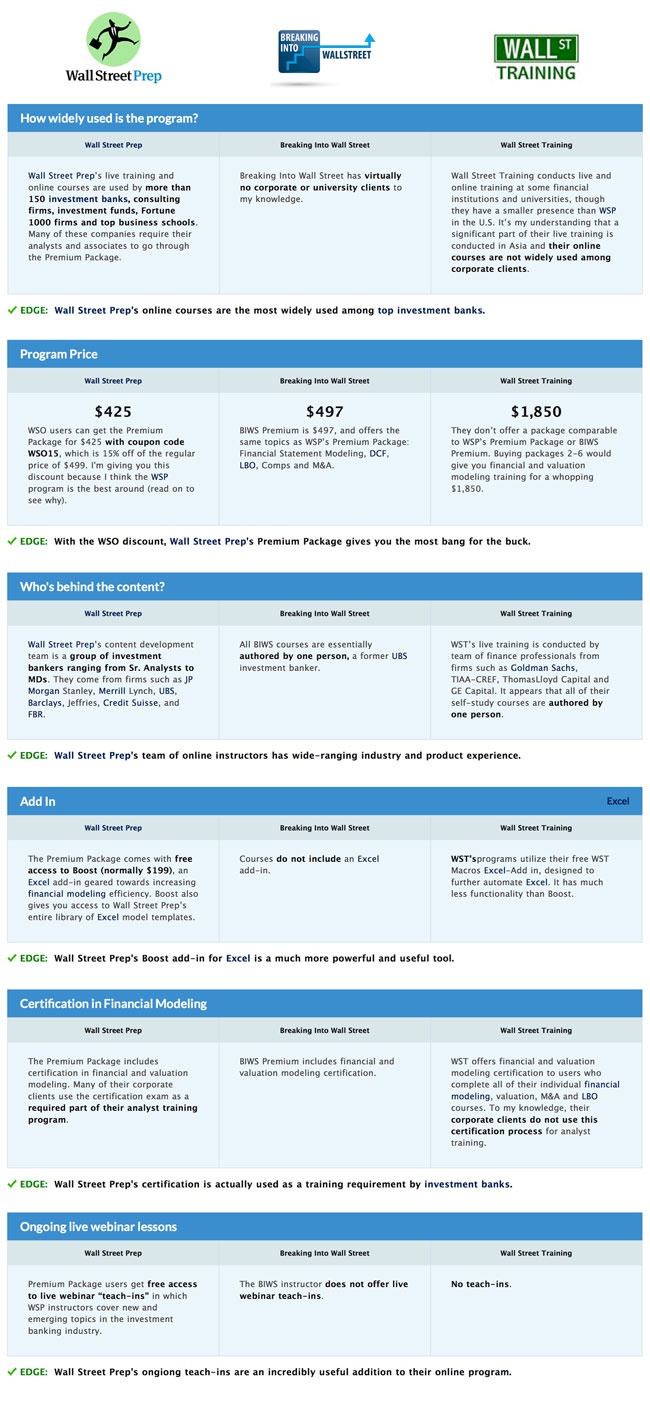

Wall street prep s accounting crash course is a great way to learn these skills.

Reading financial reports even though 3 statement financial models are designed to illuminate a firm s future performance setting up the model depends on a thorough understanding of what happened to the company in the past.

Wall street is often thought of as both the symbol and geographic center of american capitalism symbolically wall street refers to all the banks hedge funds and securities traders that drive the stock market and the whole american financial system.

We spend a lot of time making sure that our trainees understand the inter relationship of the balance sheet income statement and cash flow statement because it is so vital to properly understanding these models.

A balance sheet is one of the three financial statements that are used to value a company and to show what it owns or owes.

The balance sheet is split into three sections.

The balance sheet lists all assets liabilities and shareholder s equity attributed to the company.

Download wso s free balance sheet model template below.

It is always a snapshot of one point in time.